Current Mortgage Rates and the Political Landscape: How 2025 Policies Are Shaping Home Financing

- Jake Kilts

- Mar 5, 2025

- 3 min read

Introduction

The housing market in 2025 continues to be influenced by shifting mortgage rates, economic policies, and political developments. As interest rates fluctuate, homebuyers, real estate investors, and sellers are closely watching how government decisions impact borrowing costs. This blog post will break down the current mortgage rate trends, the political factors influencing them, and what homeowners and buyers can expect in the coming months.

Current Mortgage Rate Trends (March 2025)

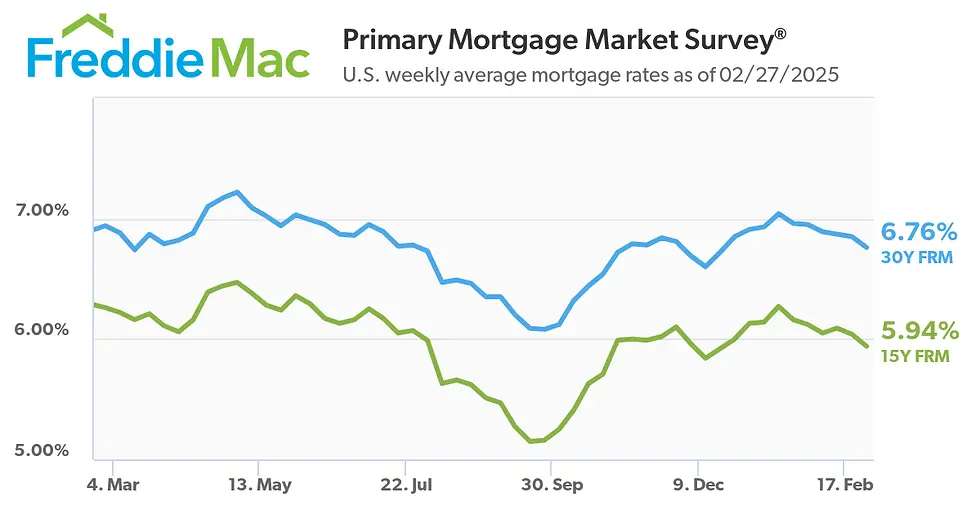

According to the latest reports, the average 30-year fixed mortgage rate is hovering around 6.85%, while the 15-year fixed rate sits at 6.10%. Adjustable-rate mortgages (ARMs) are averaging 5.75%. These numbers represent a slight decrease from the peak seen in late 2024, but they remain significantly higher than pre-pandemic levels.

Key factors influencing mortgage rates include:

Federal Reserve Monetary Policy: The Fed has taken a cautious approach in 2025, keeping rates steady with the possibility of gradual cuts later in the year.

Inflation and Economic Data: Inflation, though lower than last year, remains above the Fed’s target of 2%, impacting rate decisions.

Housing Market Demand: Inventory shortages continue to keep home prices elevated, which affects affordability despite slightly declining rates.

Political Factors Impacting Mortgage Rates

1. Federal Reserve and Monetary Policy Decisions

The Federal Reserve remains at the center of interest rate discussions. With inflation slowing but still a concern, the Fed has maintained a cautious stance on rate cuts. Recent Congressional debates over fiscal policy—including government spending, tax policy, and national debt concerns—are influencing the Fed’s next steps.

2. Housing Policy and Affordability Initiatives

As housing affordability remains a major issue, new policies aimed at first-time buyers and low-income households have been proposed:

Down Payment Assistance Programs: Several bills are under discussion to expand federal assistance programs for first-time buyers.

Expansion of FHA Loan Limits: Adjustments to Federal Housing Administration (FHA) loan caps could make homeownership more accessible.

Affordable Housing Investments: A push for increased funding in affordable housing projects is underway, particularly in urban areas.

3. 2025 Presidential & Congressional Influence

With the 2024 elections behind us, new leadership in Congress and the White House is shaping the economic and housing landscape. The administration’s stance on tax cuts, infrastructure spending, and housing incentives will play a major role in where mortgage rates head next.

Current legislative discussions include:

Mortgage Interest Deduction Reforms: Proposed changes to tax deductions for homeowners could shift buying power.

Rent Control vs. Market Expansion: Some lawmakers are advocating for stricter rent control policies, while others push for deregulation to encourage new housing development.

What Does This Mean for Homebuyers & Homeowners?

For those looking to buy a home, timing matters. With rates expected to remain stable or decline slightly, waiting for potential Fed rate cuts later in 2025 might lead to better financing options. However, if home prices continue rising due to limited supply, locking in a rate sooner rather than later could be a smart move.

For current homeowners, refinancing opportunities could emerge later in the year if the Fed lowers rates. Those with adjustable-rate mortgages (ARMs) should monitor rate changes closely and consider locking in a fixed rate if they anticipate higher long-term borrowing costs.

Conclusion: A Market in Transition

Mortgage rates in 2025 remain high compared to past years but show signs of stabilization. Political decisions, economic trends, and Federal Reserve actions will determine whether rates drop in the latter half of the year. Buyers and sellers should stay informed and work with real estate professionals to make the best financial decisions in this evolving market.

Comments